I found myself resonating a lot with this explanation:

1/ We’ve all heard the NFT elevator pitch.

-infinite royalties for artists

-ownership for communities

-24/7 marketplaces

-token-gated unlocks

That’s all well and good, but what NFTs do next is going to 🤯 your mind. 🧵

2/ Retail

Retailers from 7-11 to Gamestop will use NFTs to incentivize IRL transactions, leveraging creators to drive traffic to storefronts.

For example, Yeezy NFTs that only unlock with purchases from Gap stores, or NFTs that unlock exclusive features for Tesla vehicles.

3/ Services

NFTs will unlock access to services and hobbyist communities. Q&As and tutorials with influencer chefs, photographers, doctors, and niche enthusiastic communities will boom.

This will also extend into IRL services like transportation, hotels, and massages.

4/ Activism

Communities where NFT ownership supports political causes will gain traction as millions flow into community wallets.

Imagine a Climate Change NFT collective where sales are directed towards lobbying efforts, and those efforts are coordinated by a community DAO.

5/ Social Feed Marketplaces

Social feeds based on NFT collections will emerge, providing insight into the strategy of top collectors, and a platform for collectors to interact.

These feeds will evolve into social commerce marketplaces, featuring reviews, analytics, and more.

6/ Multiplayer

NFTs will create hive activity by incentivizing group behavior. MMORPGs that unlock levels once 10k users have aped in. Airdrops of rare NFTs to users that have signed contracts to merge their base-layer NFTs.

Collecting is going to become a team sport.

7/ NFT Borrowing Platforms

Because NFTs can unlock temporary access—like entry to conferences—markets for short-term lending are emerging. For example, I’ve personally leant friends $FWB so that they could attend events.

Imagine this as a marketplace: StubHub, but for NFTs.

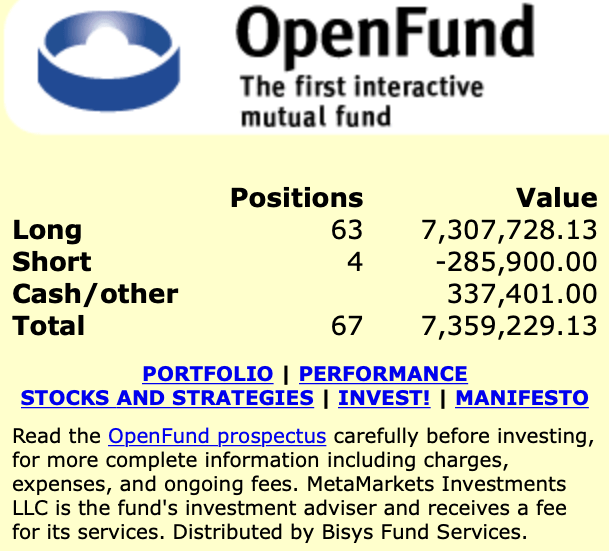

8/ NFT Indexes

Getting exposure to hundreds of NFTs via indexes will boom as market movers tap collectors for funds.

Imagine a Christie’s NFT ETF. They have the influence to get assets to liquidity—investors will ape into that.

It will also broaden support for NFT communities.

9/ Collateralization

To date, lenders have been averse to NFT holders borrowing against their assets.

But as institutional $$$ flows in, and assets become better stores of value, collateral markets will promise flexibility and liquidity for all NFT holders, not just whales.

10/ Fractionalization

Splitting up NFTs into individual shares gives more people exposure to blue-chip assets, like owning a piece of a cryptopunk.

The result? More liquidity for holders, and more appreciation of blue chip assets as money enters the markets.

11/ DeFi

As enthusiasts become more comfortable staking and farming their holdings for yield, NFTs promise incentive beyond APY%.

NFTs will become base DeFi assets, with community access included. These won't be simple savings plays—they'll also be investments in communities.

12/ Loyalty Exchanges

As brands and creators seek to reinforce loyalty, community behavior will be rewarded with NFTs. Did the member contribute content? NFT. Complete surveys? NFT. Make a purchase? NFT.

Tokens are more liquid and bragworthy than traditional discount codes.

13/ R&D

Brands and creators will exchange NFTs for insights on product development: pain points, marketing claims, roadmap and more.

The NFTs will unlock early access to product releases and potential profit sharing. Brands will track and maintain these key relationships.

14/ Content Submission

Users will submit content like short form videos, reviews, and tutorials in exchange for NFTs. It’s a marketing flywheel.

Rights can be programmed into contracts so that the use of the contributor’s content in advertising could yield them future profits.

15/ Customer Cohort NFTs

Imagine receiving an NFT for being one of the first Air Jordan customers, and how valuable that would be today. How Nike might reward you years later with special access and product.

Cohort NFTs prove that you took a certain action, at a certain time.

16/ Education and Customer Support

Upon demonstrating exceptional knowledge of a brand’s product, users can receive NFTs in exchange for onboarding newbies into the community, or providing support.

This can be exponentially more impactful than a brand employee doing the same.

17/ Bounties

Creators and brands will drop unique quests within communities, rewarding completion with NFTs. This could be anything from completing a questionnaire, to referring members into the community, to attending events.

Bounties can be highly competitive, or open wide.

18/ Leaderboards

NFT communities will gamify by highlighting the performance and participation of top holders.

Top contributors will receive rewards and clout, thereby incentivizing communities to hold and participate in order to secure better returns on their investments.

19/ We are so early, and the future is so bright. The promise of NFT technology to democratize and reward community participation grows every day. This punk is bullish.

For more tweetstorms on the future of crypto, follow @chriscantino.

Thx for reading.

Originally tweeted by Chris Cantino (@chriscantino) on November 10, 2021.